You are viewing this post: Bond Yield คืออะไร | Wealth Q\u0026A | thai bond yield

Table of Contents

Bond Yield คืออะไร | Wealth Q\u0026A

นอกจากการดูบทความนี้แล้ว คุณยังสามารถดูข้อมูลที่เป็นประโยชน์อื่นๆ อีกมากมายที่เราให้ไว้ที่นี่: ดูเพิ่มเติม

คำถาม(Q): บอนด์ยีลด์ (Bond Yield) คืออะไร

คำตอบ(A): ติดตามคำตอบได้ในคลิปนี้

.

ติดตามรายการ Morning Wealth ทุกวันจันทร์ศุกร์ เวลา 07.0008.00 น. ทาง Facebook และ YouTube ของ THE STANDARD WEALTH

.

บอนด์ยีลด์ BondYield พันธบัตร ตราสารหนี้ WealthQandA ศัพท์ลงทุน ศัพท์หุ้น ศัพท์เศรษฐกิจ MorningWealth THESTANDARDWEALTH เฟิร์นศิรัถยา วิทย์สิทธิเวคิน

ช่องทางรับชม THE STANDARD WEALTH

YouTube: youtube.com/c/thestandardwealth

Facebook: facebook.com/thestandardwealth

Twitter: twitter.com/standard_wealth

Instagram: instagram.com/thestandardwealth

Website: thestandard.co/wealth

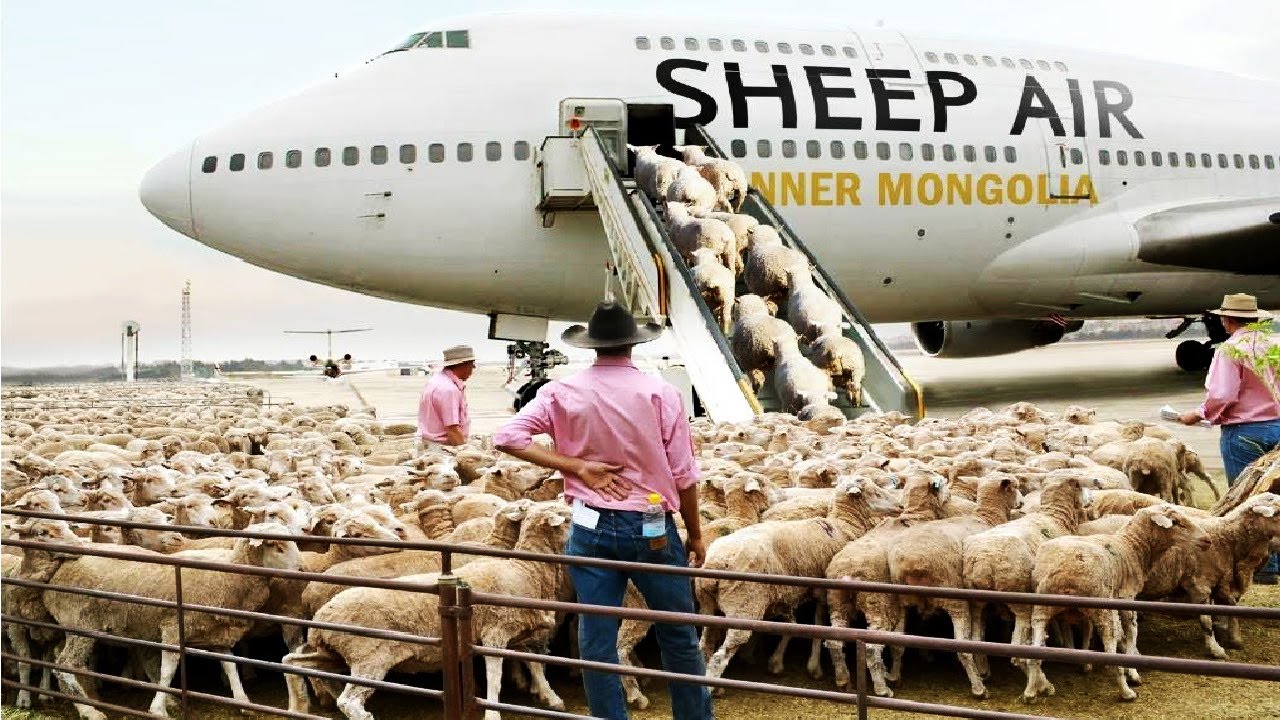

How to export millions of sheep, pig, cows – Modern Transport Technology by aircraft and big ship

Live export is the commercial transport of livestock across national borders. The trade involves a number of countries with the Australian live export industry being one of the largest exporters in the global trade.

If you are the owner, send me a comment on the video. I will follow your request as soon as read. Thank you\r

\r

Thank For Watching Noal Farm\r

For more Hot video Please Sub me Here: https://goo.gl/AECnmd\r

\r

And More playlist\r

Noal Farm : https://goo.gl/tYZdNC\r

Noal Sea : https://goo.gl/vvh4j1\r

\r

noalfarm noalharvesting ModernExport

Investopedia Video: Bond Yields – Current Yield and YTM

The current yield and yield to maturity (YTM) are two popular bond yield measures. The current yield tells investors what they will earn from buying a bond and holding it for one year. The yield to maturity (YTM) is the bond’s anticipated return if held until it matures.

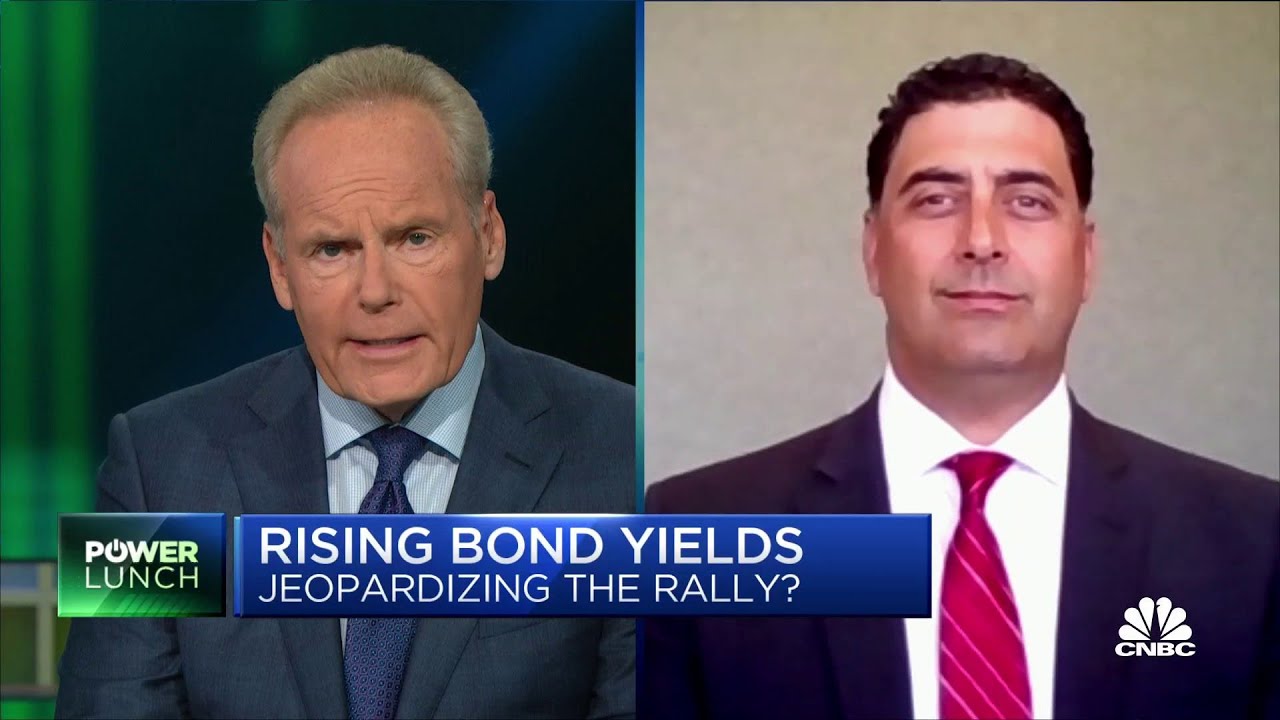

What rising bond yields mean for the equity bull run

Greg Dimarzio, Rockland Trust vice president and portfolio manager, joins ‘Power Lunch’ to discuss why he says rising bond yields aren’t bad news for the market. For access to live and exclusive video from CNBC subscribe to CNBC PRO: https://cnb.cx/2NGeIvi

U.S. Treasury yields bounced higher on Monday, continuing their upward momentum from last week as the Federal Reserve moves closer to easing off its pandemicera policies.

The yield on the benchmark 10year Treasury note climbed above the key 1.5% level in early trading, at one point rising above 1.51%. The yield was up by 1.9 basis points to 1.48% in afternoon trading. The yield on the 30year Treasury bond rose slightly to 1.992%. Both measures are trading near their highest levels in roughly three months. Yields move inversely to prices and 1 basis point is equal to 0.01%.

» Subscribe to CNBC TV: https://cnb.cx/SubscribeCNBCtelevision

» Subscribe to CNBC: https://cnb.cx/SubscribeCNBC

» Subscribe to CNBC Classic: https://cnb.cx/SubscribeCNBCclassic

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

The News with Shepard Smith is CNBC’s daily news podcast providing deep, nonpartisan coverage and perspective on the day’s most important stories. Available to listen by 8:30pm ET / 5:30pm PT daily beginning September 30: https://www.cnbc.com/2020/09/29/thenewswithshepardsmithpodcast.html?__source=youtube%7Cshepsmith%7Cpodcast

Connect with CNBC News Online

Get the latest news: http://www.cnbc.com/

Follow CNBC on LinkedIn: https://cnb.cx/LinkedInCNBC

Follow CNBC News on Facebook: https://cnb.cx/LikeCNBC

Follow CNBC News on Twitter: https://cnb.cx/FollowCNBC

Follow CNBC News on Instagram: https://cnb.cx/InstagramCNBC

https://www.cnbc.com/select/bestcreditcards/

CNBC

CNBCTV

Luke Gromen: The Growing Recognition of Negative Bond Yields

Tom welcomes Luke Gromen of Forest for the Trees back to the show.

To subscribe to our newsletter and get notified of new shows, please visit http://palisadesradio.ca

Luke is concerned about the United States debt to GDP ratio. Once a certain threshold of debt is reached countries normally enter a period of stagnancy. Today, there is a binary aspect to Fed policies as they are expected to do either too much or not enough.

The U.S. Bond markets today have around seventy trillion in assets and there is a slow move from bonds to other assets including crypto. Investors are looking for anything that protects purchasing power.

Luke outlines the future obligations of the United States and why these are enormous issues. The debt ceiling is just a political football and it would be shocking if they didn’t raise it. The government today is two wings of the same bird. Both parties spend ridiculous amounts and they both believe that deficits don’t matter. This is certainly a bad sign and an indication of problems to come.

He expects the Fed to taper but it will be in appearance only. Like a drug user hiding an addiction, the Fed will begin injecting liquidity into other areas while ‘tapering’. This will improve the Fed’s credibility however the reality will be that nothing much will have changed. It will all be sleight of hand.

Luke discusses different scenarios for how the United States could get out of the debt crisis. All of which would require massive growth on the order of 1520% GDP annually for an extended period.

China appears to be dealing with debt problems by restructuring, firing management, and allowing shareholders to be wiped out. Ironically, this is what we should have done back in 2008 but instead, we have been centrally planning everything.

He feels the world is passing peak cheap oil and that prices will shift higher from here. Fracking and shale oil may become more feasible as prices rise. However, the cheap capital that used to be available for that industry is far less today.

Physical gold is an asset that is no one else’s liability. No one else should have a claim to it. Today, the value of everything is tied in some way to energy. Gold doesn’t carry that risk because the energy has already been expended.

Time Stamp References:

0:00 Introduction

0:47 Inflation

4:30 Bond Market Size

8:00 Interest \u0026 Obligations

13:37 Debt Ceiling

15:40 Heroin Addiction

18:35 QE \u0026 Bank Reserves

21:43 Finding a Way Out?

26:04 Transition Mechanisms

28:00 China Defaults?

30:20 Energy \u0026 Peak Oil

34:23 Shale \u0026 EROI

36:40 Bitcoin \u0026 China

43:17 Gold \u0026 Energy

46:50 Bitcoin \u0026 Energy

50:03 Signposts

52:16 Wrap Up

Talking Points From This Episode

Inflation and sovereign debt risks.

Future obligations and the debt ceiling.

Why the next taper will be sleight of hand.

China’s policies, the outlook for bitcoin, and energy.

Guest Links:

Twitter: https://twitter.com/lukegromen

Website: https://ffttllc.com/

Luke Gromen began his career in the mid1990s in Research at Midwest Research before moving over to institutional equity sales and becoming a partner. While in sales, Luke was a founding editor of Midwest’s widelyread weekly summary (\”Heard in the Midwest\”) for the firm’s clients. He aggregated and combined proprietary research from Midwest with inputs from other sources.

In 2006, Luke left FTN Midwest to become a founding partner of Cleveland Research Company. At CRC, Luke continued to work in sales and edit CRC’s flagship weekly research summary piece (\”Straight from the Source\”) for the firm’s customers.

In 2014, Luke left Cleveland Research to found FFTT, LLC (\”Forest for the Trees\”), a macro/thematic research firm catering to institutions and individuals that aggregates a wide variety of macroeconomic, thematic, and sector trends in an unconventional manner to identify investable developing economic bottlenecks.

Luke also provides strategic consulting services for corporate executives. He is a graduate of the University of Cincinnati and received his MBA from Case Western Reserve University and earned the CFA designation in 2003.

LukeGromen FFTTLLC DebtMarkets Stimulus Inflation Deficits Bonds FederalReserve Gold Energy Oil Crypto Bitcoin China

นอกจากการดูหัวข้อนี้แล้ว คุณยังสามารถเข้าถึงบทวิจารณ์ดีๆ อื่นๆ อีกมากมายได้ที่นี่: ดูวิธีอื่นๆINVESTMENT

Articles compiled by CASTU. See more articles in category: INVESTMENT