You are viewing this post: Yield to Maturity (YTM) Calculation | yield to maturity

Table of Contents

Yield to Maturity (YTM) Calculation

นอกจากการดูบทความนี้แล้ว คุณยังสามารถดูข้อมูลที่เป็นประโยชน์อื่นๆ อีกมากมายที่เราให้ไว้ที่นี่: ดูความรู้เพิ่มเติมที่นี่

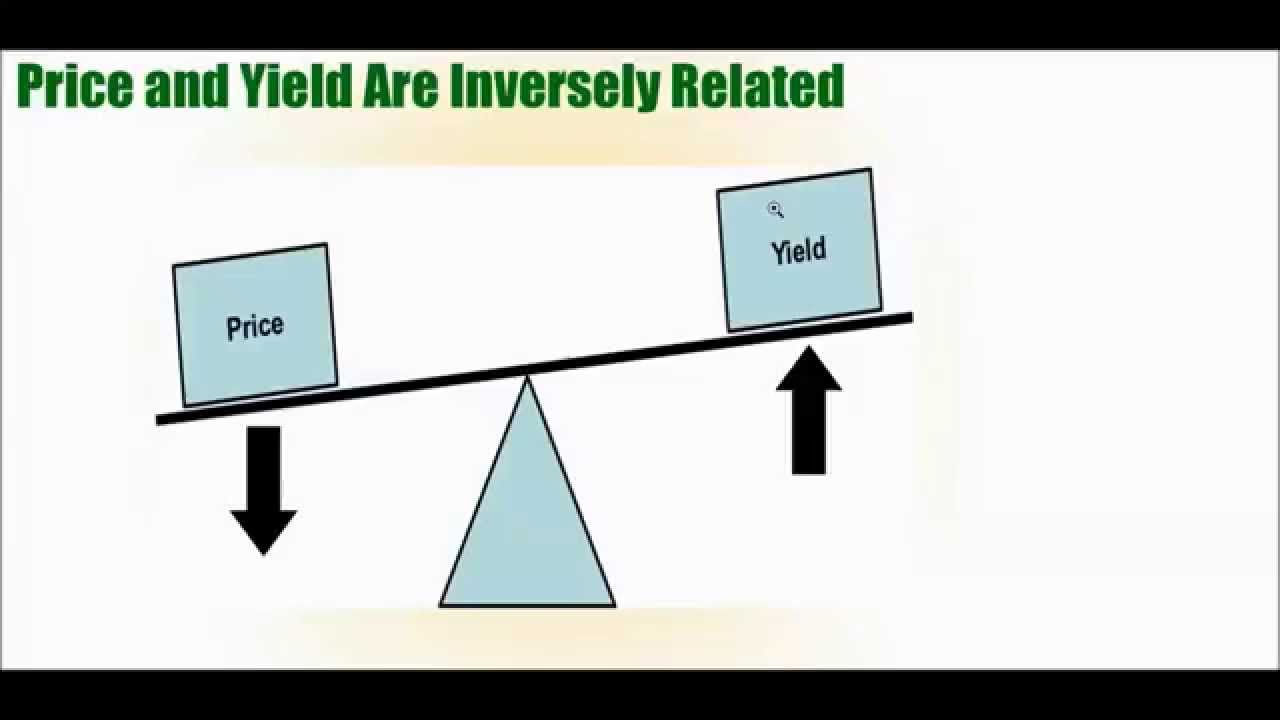

Why Bond Prices and Yields are Inversely Related

Help us make better videos: http://www.informedtrades.com/donate

Trade stocks and bonds with Scottrade, the broker Simit uses: http://bit.ly/scottradeIT (see our review: http://bit.ly/scottradeIT2)

KEY POINTS

1. Bond prices and bond yields move in opposite directions. When bond prices go up, that means yields are going down; when bond prices go down, this means yields are going up. Mathematically, this is because yield is equal to:

annual coupon payments/price paid for bond

A decrease in price is thus a decrease in the denominator of the equation, which in turn results in a larger number.

2. Conceptually, the reason for why a decrease in bond price results in an increase bond yields can be understood through an example.

a. Suppose a corporation issues a bond to a bondholder for $100, and with a promise of $5 in coupon payments per year. This bond thus has a yield of 5%. ($5/$100 = 5%)

b. Suppose the same corporation then issues additional bonds, also for $100 but this time promising $6 in coupon payments for year and thus yielding 6%.

No rational investor would choose the old bond; instead, they would all purchase the new bond, because it yielded more and was at the same price. As a result, if a holder of the old bonds needed to sell them, he/she would need to do so at a lower price. For instance, if holder of the old bonds was willing to sell it at $83.33, than any prospective buyer would get a bond that earned $5 in coupon payments on an $83.33 payment effectively an annual yield of 6% (5/83.33). The yield to maturity could be even higher, since the bond would give the bondholder $100 upon reaching maturity.

3. The longer the duration of the bonds, the more sensitivity there is to interest rate moves. For instance, if interest rates rise in year 3 of a 30 year bond (meaning there are 27 years left until maturity) the price of the bond would fall more than if interest rates rise in year 3 of a 5 year bond. This is because an interest in interest rates reduces the relative appeal of existing coupon payments, and the more coupon payments that are remaining, the more interest rate fluctuations will impact the price of the bond.

4. Lastly, a small note on jargon: when investors or commentators say, \”bonds are up,\” (or down) they are referring to bond prices. \”Bonds are up\” thus means bond prices are up and yields are down; conversely, \”bonds are down\” means bond prices are down and yields are up.

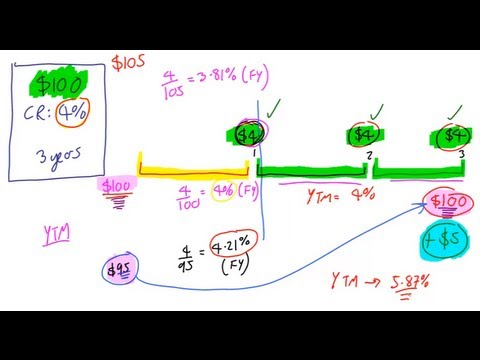

Introducing Yield To Maturity, Lecture 012, Securities Investment 101, Video 00014

In this introductory lecture, we explain the conceptual framework behind ‘Yield To Maturity’ and why it is conceptually different from ‘Flat Yield’.

In the next two lectures, we will further explore the ideas put forward in this lecture, and both price a bond, given a yield to maturity input, and calculate a yield to maturity, given a bond price input.

Previous: http://www.youtube.com/watch?v=J0QNupJbBsw

Next: http://www.youtube.com/watch?v=C1bUPfeBo0

For financial education from London to Singapore and beyond, please contact MithrilMoney via the following website:

http://mithrilmoney.com/

This MithrilMoney lecture was delivered by Andy Duncan, CQF.

Please read our disclaimer:

http://mithrilmoney.com/disclaimer/

Solving for A Bond’s Yield to Maturity with Semiannual Interest Payments

Here I solve a yield to maturity on a bond that pays semiannual interest payments.

If this video helps, please consider a donation: https://www.paypal.com/cgibin/webscr?cmd=_donations\u0026business=T2MPM6MSQ3UT8\u0026currency_code=USD\u0026source=url

6. What is a Bond

Download Preston’s 1 page checklist for finding great stock picks: http://buffettsbooks.com/checklist

Preston Pysh is the 1 selling Amazon author of two books on Warren Buffett. The books can be found at the following location:

http://www.amazon.com/gp/product/0982967624/ref=as_li_tl?ie=UTF8\u0026camp=1789\u0026creative=9325\u0026creativeASIN=0982967624\u0026linkCode=as2\u0026tag=pypull20\u0026linkId=EOHYVY7DPUCW3WD4

http://www.amazon.com/gp/product/1939370159/ref=as_li_tl?ie=UTF8\u0026camp=1789\u0026creative=9325\u0026creativeASIN=1939370159\u0026linkCode=as2\u0026tag=pypull20\u0026linkId=XRE5CA2QJ3I2OWSW

In this lesson, we first learned that a bond is nothing more than a loan. There are many forms of bonds that a person can invest in, but the four primary forms are corporate bonds, Municipal Bonds, State Bonds, and Federal Bonds. We know there are inherent risks associated with purchasing a bond, but many of them can be mitigated by treating the investment as if you were a bank lender.

We learned that Bonds can be a very lucrative investment as long as you purchase the security (or bond) at a strong yield and minimal risk. If you’re purchasing a bond as a long term investment, we know that it’s market price will be more volatile during the first 15 years as interest rates change. Intelligent investors can take advantage of these price fluctuations is they know how to properly value the bonds.

นอกจากการดูหัวข้อนี้แล้ว คุณยังสามารถเข้าถึงบทวิจารณ์ดีๆ อื่นๆ อีกมากมายได้ที่นี่: ดูวิธีอื่นๆINVESTMENT

Articles compiled by CASTU. See more articles in category: INVESTMENT