You are viewing this post: The power of introverts | Susan Cain | credit risk คือ

Table of Contents

The power of introverts | Susan Cain

นอกจากการดูบทความนี้แล้ว คุณยังสามารถดูข้อมูลที่เป็นประโยชน์อื่นๆ อีกมากมายที่เราให้ไว้ที่นี่: ดูความรู้เพิ่มเติมที่นี่

Visit http://TED.com to get our entire library of TED Talks, transcripts, translations, personalized talk recommendations and more.

In a culture where being social and outgoing are prized above all else, it can be difficult, even shameful, to be an introvert. But, as Susan Cain argues in this passionate talk, introverts bring extraordinary talents and abilities to the world, and should be encouraged and celebrated.

The TED Talks channel features the best talks and performances from the TED Conference, where the world’s leading thinkers and doers give the talk of their lives in 18 minutes (or less). Look for talks on Technology, Entertainment and Design plus science, business, global issues, the arts and more. You’re welcome to link to or embed these videos, forward them to others and share these ideas with people you know.

Follow TED on Twitter: http://twitter.com/TEDTalks

Like TED on Facebook: http://facebook.com/TED

Subscribe to our channel: http://youtube.com/TED

TED’s videos may be used for noncommercial purposes under a Creative Commons License, Attribution–Non Commercial–No Derivatives (or the CC BY – NC – ND 4.0 International) and in accordance with our TED Talks Usage Policy (https://www.ted.com/about/ourorganization/ourpoliciesterms/tedtalksusagepolicy). For more information on using TED for commercial purposes (e.g. employee learning, in a film or online course), please submit a Media Request at https://mediarequests.ted.com

The Credit Decision (FRM Part 2 – Book 2 – Chapter 1)

For FRM (Part I \u0026 Part II) video lessons, study notes, question banks, mock exams, and formula sheets covering all chapters of the FRM syllabus, click on the following link: https://analystprep.com/shop/unlimitedpackageforfrmpartipartii/

AnalystPrep is a GARPApproved Exam Preparation Provider for FRM Exams

After completing this reading you should be able to:

Define credit risk and explain how it arises using examples.

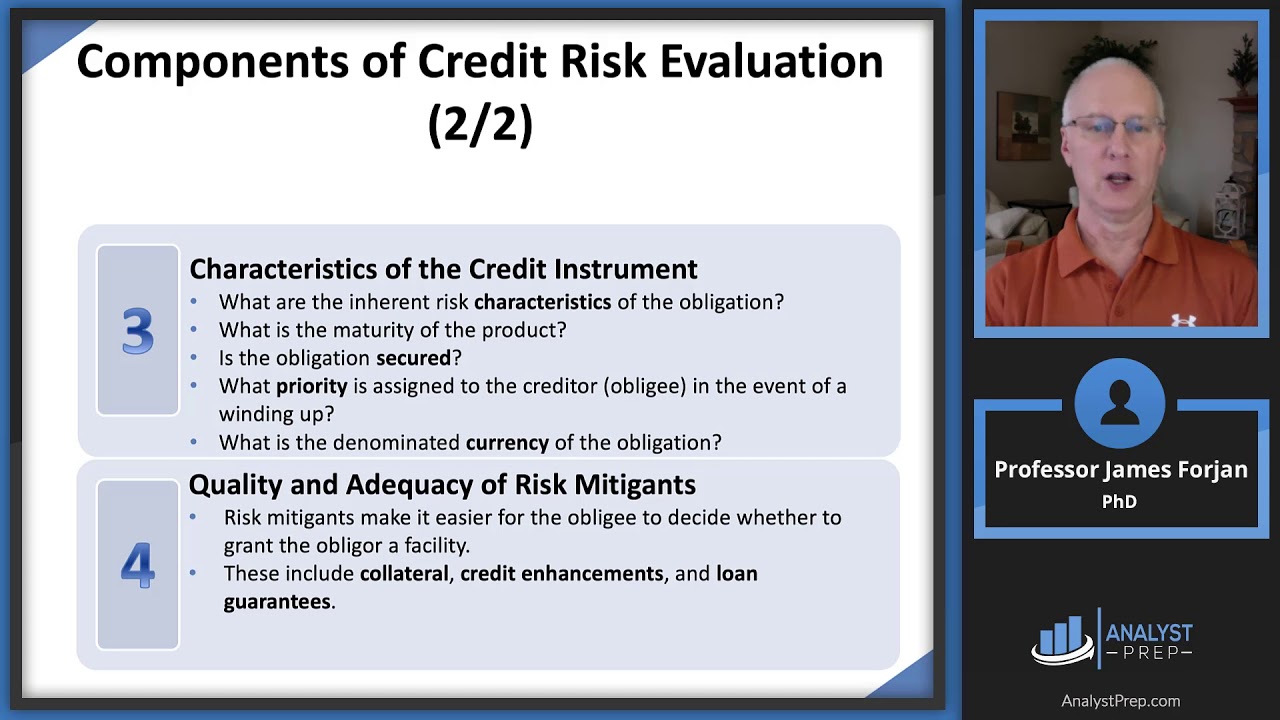

Explain the components of credit risk evaluation.

Describe, compare and contrast various credit risk mitigants and their role in credit analysis.

Compare and contrast quantitative and qualitative techniques of credit risk evaluation.

Compare the credit analysis of consumers, corporations, financial institutions, and sovereigns.

Describe quantitative measurements and factors of credit risk, including probability of default, loss given default, exposure at default, expected loss, and time horizon.

Compare bank failure and bank insolvency.

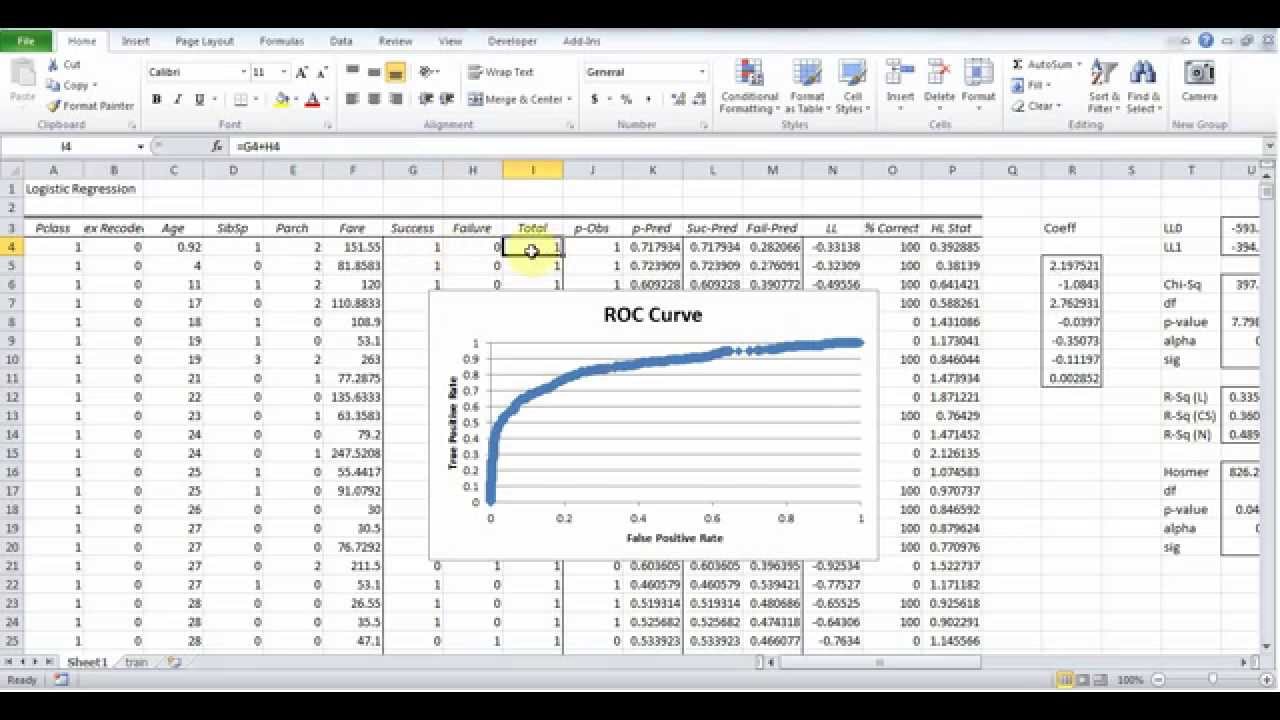

Logistic Regression Using Excel

Predict who survives the Titanic disaster using Excel.

Logistic regression allows us to predict a categorical outcome using categorical and numeric data. For example, we might want to decide which college alumni will agree to make a donation based on their age, gender, graduation date, and prior history of donating. Or we might want to predict whether or not a loan will default based on credit score, purpose of the loan, geographic location, marital status, and income. Logistic regression will allow us to use the information we have to predict the likelihood of the event we’re interested in. Linear Regression helps us answer the question, \”What value should we expect?\” while logistic regression tells us \”How likely is it?\”

Given a set of inputs, a logistic regression equation will return a value between 0 and 1, representing the probability that the event will occur. Based on that probability, we might then choose to either take or not take a particular action. For example, we might decide that if the likelihood that an alumni will donate is below 5%, then we’re not going to ask them for a donation. Or if the probability of default on a loan is above 20%, then we might refuse to issue a loan or offer it at a higher interest rate.

How we choose the cutoff depends on a costbenefit analysis. For example, even if there is only a 10% chance of an alumni donating, but the call only takes two minutes and the average donation is 100 dollars, it is probably worthwhile to call.

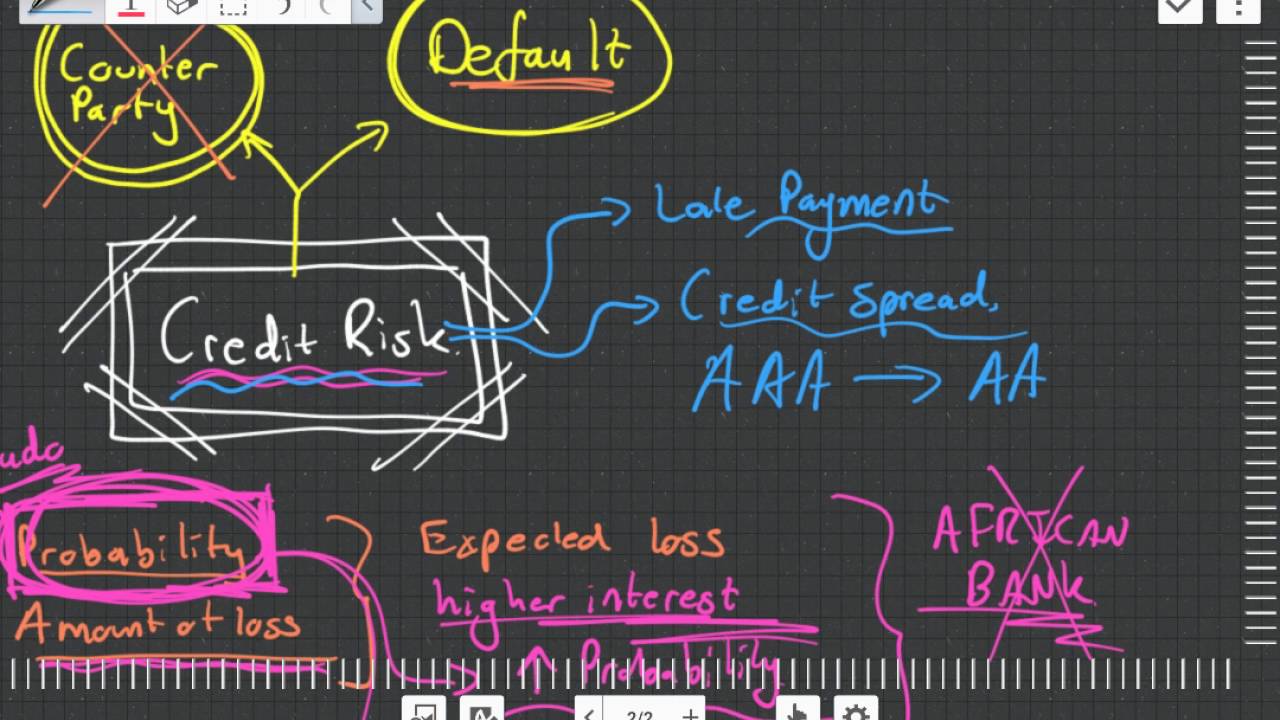

Credit Risk Introduction

these videos go through the syllabus objectives for the Financial Exams of ST5/F105/SA5/F205. They are raw, unedited and contain a large amount of opinion. I’ve taken a skeptical approach to the subject and my views may not be correct. Feel free to correct me in the comment section below. I’ll be releasing a new video every day

Let’s Keep in Contact

Hit the subscribe button if you would like to see more on Youtube.

Social Media:

LinkedIn: https://www.linkedin.com/in/michaeljordana2a56689/

Facebook Group: https://www.facebook.com/groups/229944581209468

Premium Content on Udemy:

Financial Maths \u0026 Theory of Interest

https://www.udemy.com/course/financialmathematics/?referralCode=4E9FCA556E0DA3F6A10B

Financial Engineering \u0026 Portfolio Theory

https://www.udemy.com/course/financialmarketsa/?referralCode=FD1DC24FD42A3A7D5A30

Copulas

https://www.udemy.com/course/introductiontocopulas/?referralCode=FD09B59500CFA149839D

Credit Risk Models

https://www.udemy.com/course/theoryofcreditriskmodels/?referralCode=67C9ADA77C3EE60F0BE3

Market Risk Models

https://www.udemy.com/course/measuringriskforactuaries/?referralCode=6916C37FE7EA0D6E250A

Mathematical Statistics for Actuaries

https://www.udemy.com/course/actuarialstatisticsexampct3/?referralCode=C3DC46A18BB4C5BABB88

Bayesian Statistics \u0026 Credibility Theory

https://www.udemy.com/course/bayesianstatisticsandcredibilitytheory/?referralCode=301C2AC604CF7E01D5DD

Economic Capital Management \u0026 Models

https://www.udemy.com/course/introductiontoeconomiccapitalmanagementandmodelling/?referralCode=CDA95FA457795547157D

Stochastic Processes \u0026 Markov Chains

https://www.udemy.com/course/stochasticprocessesandmarkovchains/?referralCode=EB18C3E7310E66BA4A17

Time Series

https://www.udemy.com/course/timeseriesforactuaries/?referralCode=42A9D06DCD8680E85A7A

Loss Distributions

https://www.udemy.com/course/lossdistributionsforactuarialmodels/?referralCode=9260EAA6B66B5EFB08F2

Principles of Actuarial Models

https://www.udemy.com/course/principlesofactuarialmodelling/?referralCode=E6F35A6EDE4C20F32EBF

Excel for the CM2B Exam (Financial Engineering)

https://www.udemy.com/course/excelforfinancialengineeringandlossreservingcm2b/?referralCode=1BB6634CF7AE15DE2BE8

How to become an Actuary (FREE)

https://www.udemy.com/course/howtobecomeanactuary/?referralCode=95D7C2E42AE4F27528AD

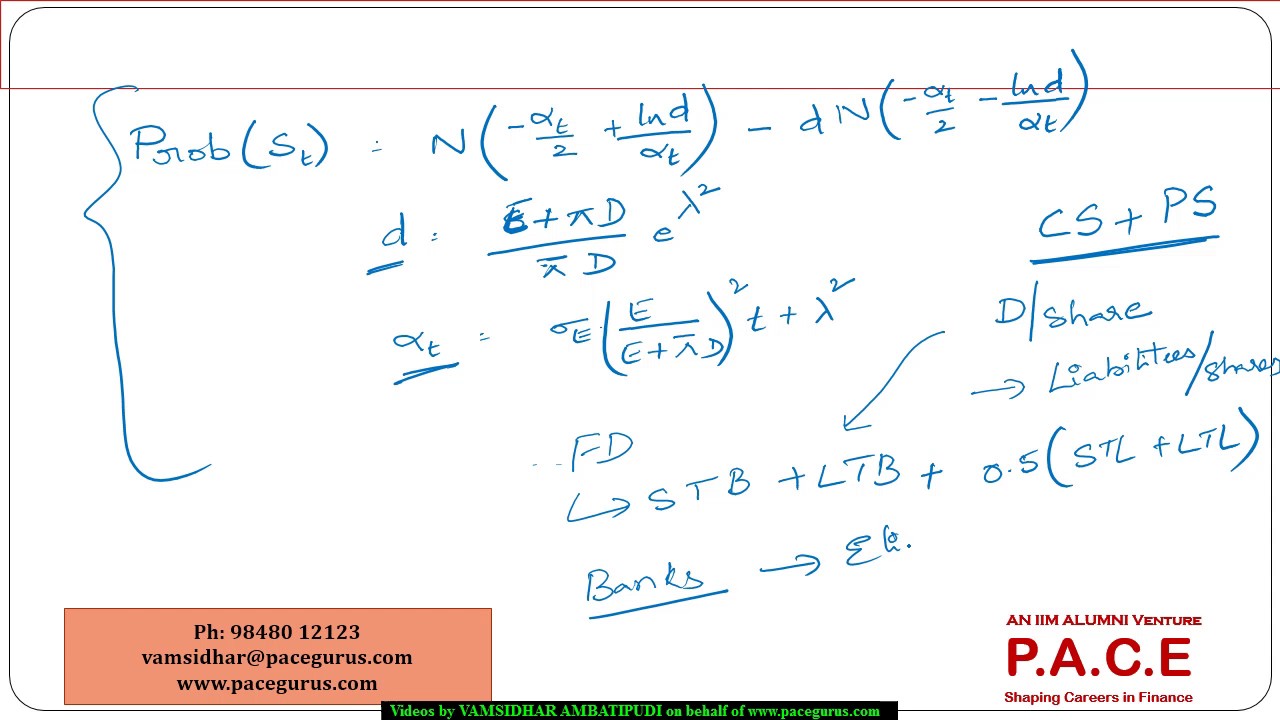

Credit Grades Estimating Probability of Default

Training on Credit Grades Estimating Probability of Default by Vamsidhar Ambatipudi

นอกจากการดูหัวข้อนี้แล้ว คุณยังสามารถเข้าถึงบทวิจารณ์ดีๆ อื่นๆ อีกมากมายได้ที่นี่: ดูวิธีอื่นๆINVESTMENT

Articles compiled by CASTU. See more articles in category: INVESTMENT